Discover more from Flippa

To Stake or Not to Stake (Domains & NFTs)

Discussing .gg domains, decentralized SLDs, Micro SaaS, taking a HoldCo public and rewarding NFT holders with a fanny pack

Hey there 👋,

In this week’s Alts by Flippa newsletter I discuss:

Buying more .gg domains

Impervious makes decentralized SLDs open to all

What happens when you reward NFT holders with a fanny pack

Are Micro SaaS good acquisitions?

Ecommerce business model trends

Taking a HoldCo public

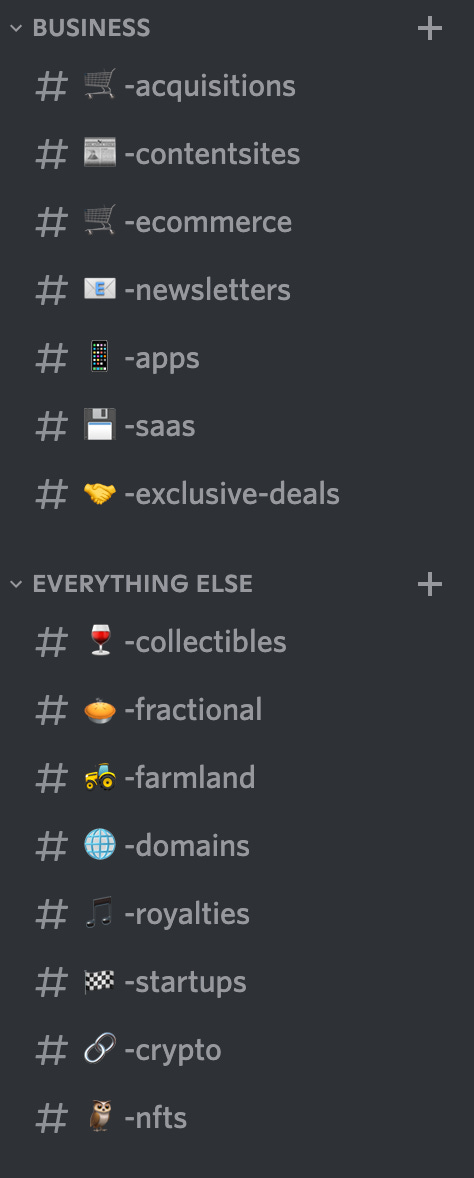

Every heading is a discussion channel in the Alts by Flippa discord community - come join over 1600 of us.

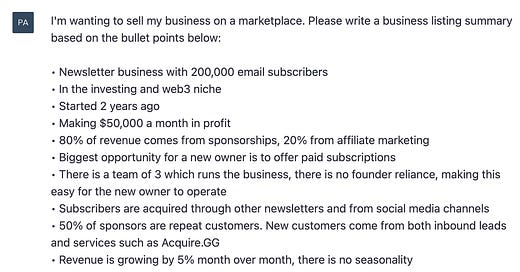

Richard Patey, Director, Investor Community at Flippa

#domains

Good Game Discord

After writing about .wtf domains in last week’s newsletter, I’ve been drawn back into looking at .gg domains (mentioned in a previous newsletter) again and have continued to buy short, left of the dot names.

I really like the fact that the .gg TLD is a short and memorable extension (and also the web address for the Bailiwick of Guernsey, part of the British Isles).

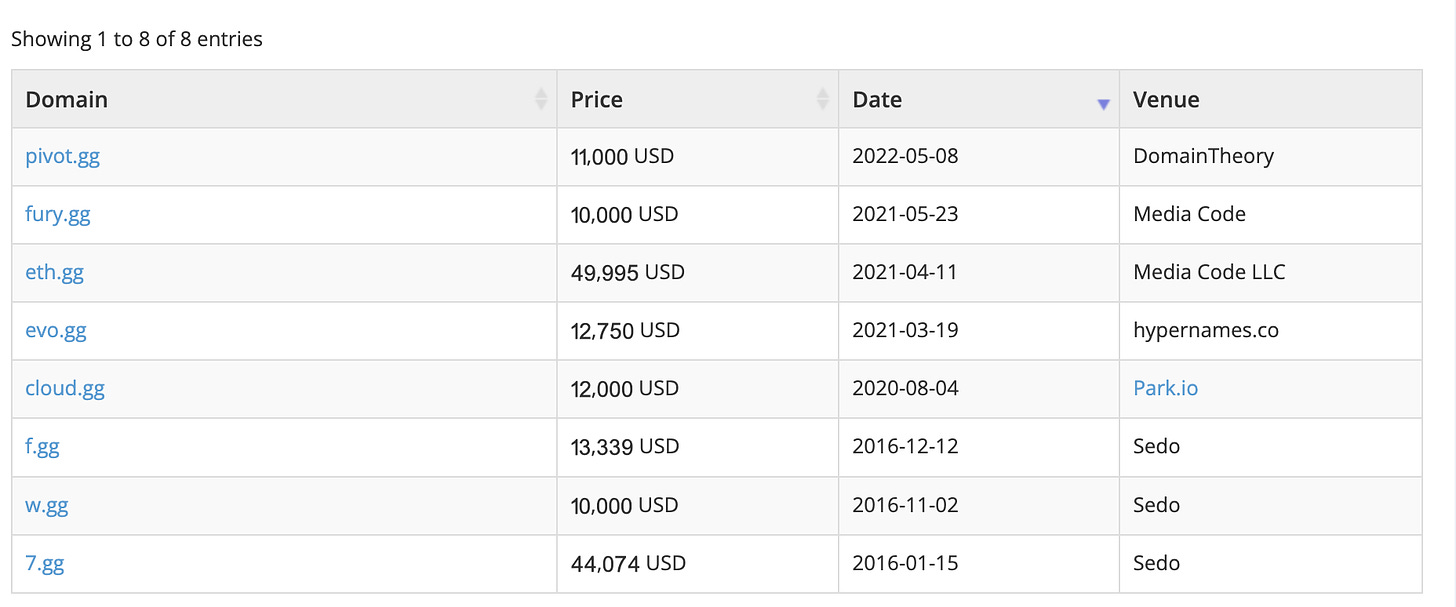

I looked up on NameBio the top .gg sales, and there were 8 recorded above five figures:

I’m pricing mine well, vs a quick flip, as my gut says that .gg will become more and more popular in the future, even though it’s expensive to renew (just like Guernsey is expensive to live in).

The highest profile example of a company using .gg is Discord for vanity URLs to people’s communities (ours is discord.gg/altsbyflippa).

Flippa Featured Domains

fashion.fm - name taken in 397 extensions (according to DotDB)

splendidbeards.com - splendid two word .com

leanbreeze.com - Godaddy Estimated Value $1,391

winthiswatch.com - good domain for a lead magnet

FunniestTweets.com - $1 reserve, 16 days left to bid

forexgraphs.com - exact match keyword domain

casino.dev - premium name taken in 509 extensions

Decentralized SLDs open to all

I mentioned in last week’s newsletter how the Namebase TLD Registry reopened so that you can stake your Handshake TLD and sell SLDs on it.

I’m considering doing this for my .lazy TLD (i.e. renting SLDs) but was thinking that selling one off domains that people truly own forever was a better model, and would wait for a solution to do this.

Then Impervious dropped this tweet:

If you decide to stake your TLD (in order to sell decentralized SLDs) this is an irreversible decision:

Can I unstake a name?

If you transfer your name to the anyone-can-renew address on the Handshake root zone, your TLD will be permanently delegated to a decentralized contract. This is currently optional. However, users will see a warning in the UI if you don't lock your name.

Which is a much bigger decision to make for a premium TLD holder, as you lose ownership and the ability to sell the TLD on.

I think it’s too early for me to do this, so will likely now apply to stake within Namebase and hope that Namecheap takes it up to sell names on.

#nfts

This owl left the nest

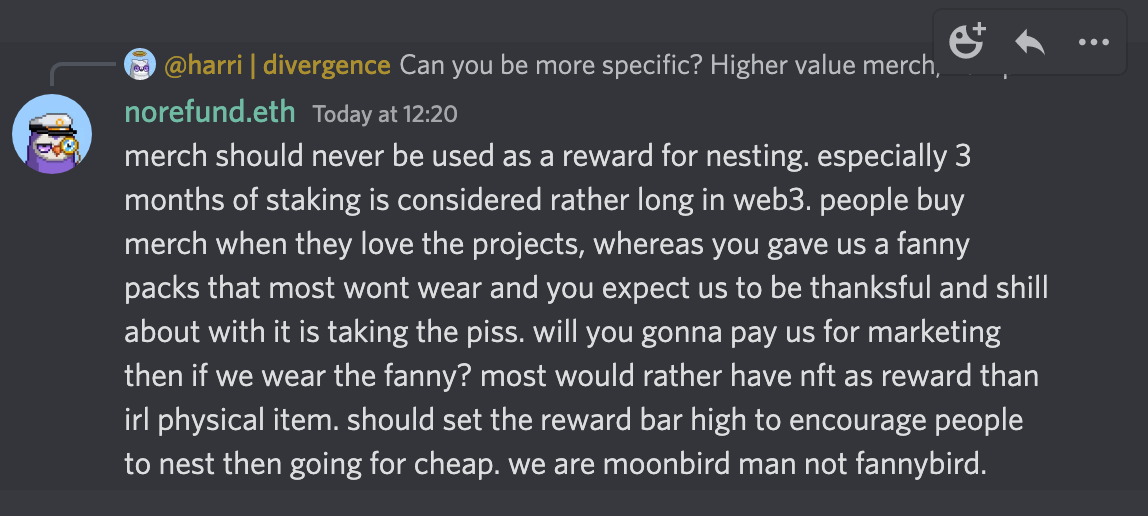

Talking of staking, Moonbirds rewarded those who had held (nested) for 90 days through a 90% drawback in USD terms with a fanny pack.

This was the reaction on Twitter:

And this was the reaction from inside the Moonbirds Discord:

After seeing what the reward was I immediately took the floor collection offer bid and sold my Moonbird.

I really feel like ETH is about to take another big dive down (due to the macro more than the technical analysis) and don’t want to be holding the bag again when NFTs get obliterated. Especially when I’m not financially rewarded in doing so.

#saas

Are Micro SaaS good acquisitions?

Rob Walling from MicroConf (and who built and sold Drip.co to Leadpages back in the day) just put out a great video about the benefits of building / buying a Micro SaaS:

They have small total addressable market (TAM) which acts like a moat from large companies entering the space.

As Micro SaaS are more like a single feature rather than a full piece of software, they are easier to maintain.

They often have a single organic marketing channel, such as google or app stores, so there is limited investment in marketing.

They don’t typically have employees, rather use freelancers, so profitability can be very high

Rob also mentions in the video a great post by Ramy from Rocket Gems on 68 B2B SaaS marketplaces.

#ecommerce

Business model trends

In a recent episode of the Ecommerce Fuel Podcast, Andrew Youderian talks about a trends report he put together after surveying entrepreneurs in his community:

It was interesting to hear that since 2017:

The number of dropshipping stores in his community has halved from 18% to 9%

Reselling other people’s products went from 23% down to 11%

Manufacturing your own product more than doubled to 40%.

It seems that the most common way to find an edge and win in ecommerce in 2022 is through owning your own product.

#acquisitions

Taking a HoldCo public

I enjoyed listening to Dom Wells on the Top M&A Entrepreneur Podcast by Jon Stoddard talking about how he’s taking his HoldCo public.

I liked the focus on how he will have both financial leverage (raising capital at 10% to buy businesses that cashflow at least 20%) and operational leverage through having an existing team in place for each new acquisition.

Dom also spoke about how he may be doing acquisitions thematically going forward may, in order to find additional leverage / efficiency.

This reminded me of Enduring Ventures by Xavier Helgesen & Sieva Kozinsky who have platform companies underneath the main HoldCo, that focus on different industries such as broadband or digital.

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

And come join over 1600 members in the Alts by Flippa Community:

Where we discuss:

Alts by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.