Discover more from Flippa

🏋️ Do you even HoldCo?

Acquisition entrepreneurship, entrepreneurship through acquisition, permanent equity, owning your future - whatever you call it, it's a way to compound 25% returns...

Well hello there, did you miss me?

Since I last emailed three weeks ago I’m down six figures in my NFT portfolio:

But I’m feeling bullish as the time off for paternity, where I consumed a large amount of investing books and podcasts, has enabled me to figure out my next step.

Before we get started, don’t forget to join over 1300 members in the Alts by Flippa Community:

Cheers!

What’s your ETA?

I’ve built and sold four businesses - a shopify store, content site, and two media properties. Plus of course the acquisition of Alts Cafe which became Alts by Flippa, but that was more an acquihire as I hadn’t monetized it yet.

But at 42, and as I’m now full-time at Flippa, I have no desire or capacity to attempt a fifth.

Building a business that can support your life expenditure is typically more than a full-time gig to achieve. And the chance that it will succeed is, as we know, very low.

But if you already have the entrepreneurial chops (and scars to show for it) and have made some capital, then entrepreneurship through acquisition (ETA) really does become the only play.

Indeed, it’s what Flippa’s Own Your Future conference is all about.

Enter the HoldCo

A Holdco is a holding company that owns operational companies.

The structure ensures that subsidiary company’s liabilities are all isolated. It also enables you to build out shared services to reduce expenditure and improve profit at the operational company level.

There’s been a lot of dedicated podcast episodes on building a Holdco and over the last 2 weeks I may have listened to them all. I’ve got three that are must shares.

The first is an episode of the Invest Like The Best podcast by Patrick OShaughnessy talking with Brent Beshore from Permanent Equity which buys and holds companies indefinitely.

On the episode, Brent calls small business acquisition “the most inefficient market in the world”. The public equity markets, in theory, should price companies correctly based on all of the publicly available information. But within the lower middle market (private companies with annual revenues of $5MM to $50MM) there is less liquidity and the greater potential to find value as a buyer.

Permanent Equity looks to acquire good businesses with free cashflow (owner earnings) of between $2.5MM to $25MM at good valuations, and they look to continue to work with the existing management teams. The homepage of the website states:

We invest in family-owned businesses for the long haul out of a 30-year, $300M fund and rarely use debt. While we are informed by trends and the latest technology, we love “boring” businesses like swimming pools, picture frames, airplane parts, and talent recruitment.

They now have 12 portfolio companies, from aerospace to recruiting.

Moving on, the second podcast is an episode of Acquiring Minds by Will Smith talking with Justin Turner from Traction Capital, on how they did their first 4 acquisitions, which includes a mattress company.

And the last episode worth mentioning is on the Think Like an Owner podcast by Alex Bridgeman, where he talked with Justin Vogt and Ed Redden of Evermore Industries (their holding company). They specialize in facilitating the transition of businesses from one generation to the next through an acquisition.

On the episode they talk about why they chose a holding company structure over a search fund:

The conclusion I think we both came to was the fact that search funds are great… it’s really about sitting down and defining what your goals are and what you want to get out of buying a small business…

And so as we explored, talked to a lot of different people in the community, it became clear that what we were looking for was more of a holding company structure…

The freedom that was allowed to us by raising a holding company rather than a traditional search - which is buy one business, operate it and sell it - but rather by having a holding company whereby we can continuously invest and operate over many years.

If the above podcasts were not enough for you, there’s even a Hold Co Conference starting this year by Kelcey Lehrich of 365 Holdings and John Wilson of Owned and Operated, and I’d love to attend the next one.

PateyCo

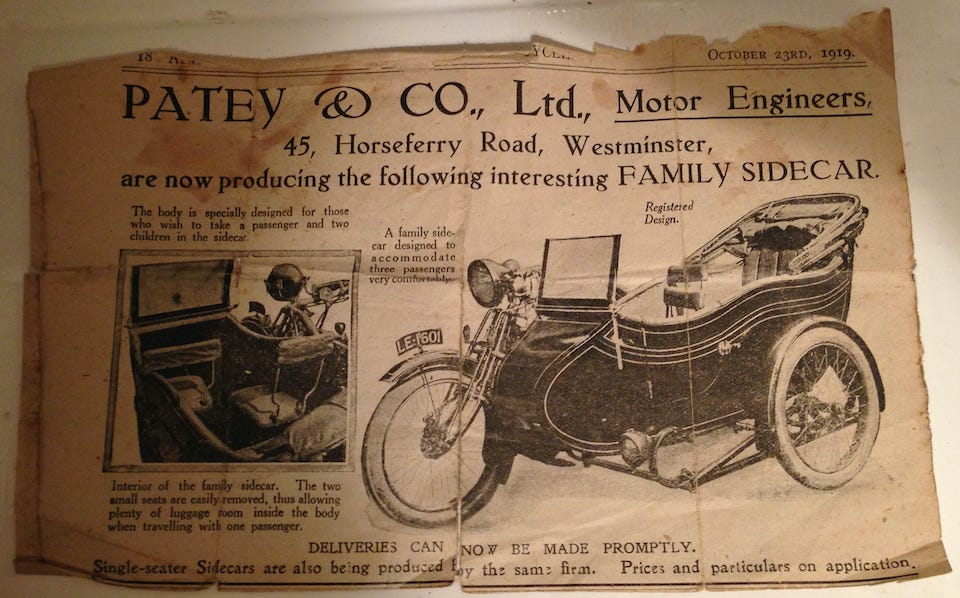

I have no idea if this was a holding company, but my great grandfather actually had a company called Patey & Co Ltd which made sidecars for motorbikes over 100 years ago:

Over the next couple of months, I’m going to be setting up a holding company, so that I’m ready to set up the operational company for the first acquisition.

And that may well be a cafe that I go to every day which I’d convert into a co-working space and use as an office. Cashflow and free coffee, what’s not to love?

I’m currently in talks with the owner and will write about how the deal goes (or doesn’t) in future newsletters. He’s using a local business broker and doesn’t want the deal to be public (i.e. wants it off-market).

I mentioned the forthcoming Flippa Off Market in the previous newsletter.

As the Flippa brand grows through local meetups (I’ll be hosting ones in London and Manchester in August and attending Berlin and Munich meetups in September), who knows what types of traditional businesses will end up choosing Flippa to sell in the future.

After all, there’s more to business than just being online 👨💻

#fractional

In other news, Vincent (the search engine for alternative investments) recently announced the launch of their fund:

A Diversified Alternatives Portfolio for the Modern Investor

Rather than pay for premium content subscriptions to try to get alpha, now you can simply (if you’re an accredited investor) invest into a bucket of assets curated by their investment team which includes Slava Rubin (who built Indigogo):

Your VALT portfolio will hold 45-60 unique assets allocated across Pre-IPO Venture, Crypto, Art & NFTs, Collectibles, Private Debt, and Real Estate.

What was strange to me was no mention of including online business (as an overall asset class) so sent out this tweet:

To which the founder of Vincent replied:

To which the CEO of Flippa replied:

Buying content sites, ecommerce stores or software companies for say 4x profit and 25% cash on cash returns, could be a great way to smooth out the harsh volatility from crypto and collectibles.

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

And come join the discord where we discuss:

Alts by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.