Discover more from Flippa

👀 $72B in liquid capital...

Flippa's buyer network has the most capital in the online business marketplace / brokerage space - how do we better match this to more deals and opportunities?

Hey there 👋,

In last week’s newsletter, I wrote about coming out of the crypto and NFT rabbit hole and how I’m now looking to reinvest profits made there into cashflowing online busineses.

Now I’m full time at Flippa, I don’t have time to operate websites nor do I want to be back in that game again. Instead, I’m looking to invest without being involved in ops, and you will see that this will be a continuing theme of this newsletter for the foreseeable future, as I discover ways to do this.

Before we get started, don’t forget to join over 1100 members in the Alts by Flippa Community:

Cheers!

ps if there’s no newsletter next week it’s because I’m on paternity…

Scaling investing in online business

Since its launch, Flippa has seen $3.6B of assets listed on its marketplace. This is a large amount of digital assets, but there’s way more than this in liquid capital on the buy side, currently $72B waiting to be invested:

So how do we scale the sell side?

Blake Hutchinson hinted in his CEO monthly update for April what’s coming next:

The new Flippa Off Market. We can’t tell you too much about this one…it’s just too juicy. Let’s just say that we will bring you thousands of more assets and verified buyers will have exclusive access. To get first and exclusive access, ensure you have a full buyer profile and have verified your available funds.

It really is juicy and will be a game changer.

But until that becomes live, how do we, as investors, put more money into online business in a +EV way? (link to recent presentation by Nate Silver on the how gamblers think at the All-In Summit).

For me, it comes down to finding operators of existing successful, profitable businesses that are open to giving away equity.

When I was running Flipping Websites back in the day (which got acquired and became Buzz Logic) I had a page on the site where operators would apply to be matched with a list of investors I had built. I would vet these operators and then find a suitable investor who was looking to deploy six figures into a content site.

One of the people I matched was a friend and the best operator I know, Ruaan who I interviewed when was running the Website Investing Podcast. He did a fantastic job scaling an investor’s site and they exited together, but it became clear that there just wasn’t enough upside in running other people’s websites when you’re already successful. When you’re making five figures a month from your own portfolio, you can simply reinvest profit into new acquisitions for your team to run.

As such, the best website managers likely won’t be raising money from investors and running a fund. They will be focussed on scaling their own portfolio.

The opposite approach to this is Recurrent - a digital media company founded in 2018 by Andrew Perlman and Matt Sechrest from the venture equity firm North Equity. Recurrent owns 24 digital media brands such as thedrive.com, and recently announced that it secured $300M (!) in new funding (led by Blackstone Tactical Opportunities). This was to scale its operations and build its technology platform for advertisers, expanding its video presence, and was on top of a $75M capital rise back in just October last year.

But back to the question - how can I put money into an existing online business portfolio where:

I don’t buy 100% of the asset

I’m not involved in operations

I do not need to find an operator (as they are already running the business)

To find the solution, I’m looking to the off-line business world.

I’ve been following Codie Sanchez from Contrarian Thinking for a while now and recently watched this video on how she invested $100K into a laundromat:

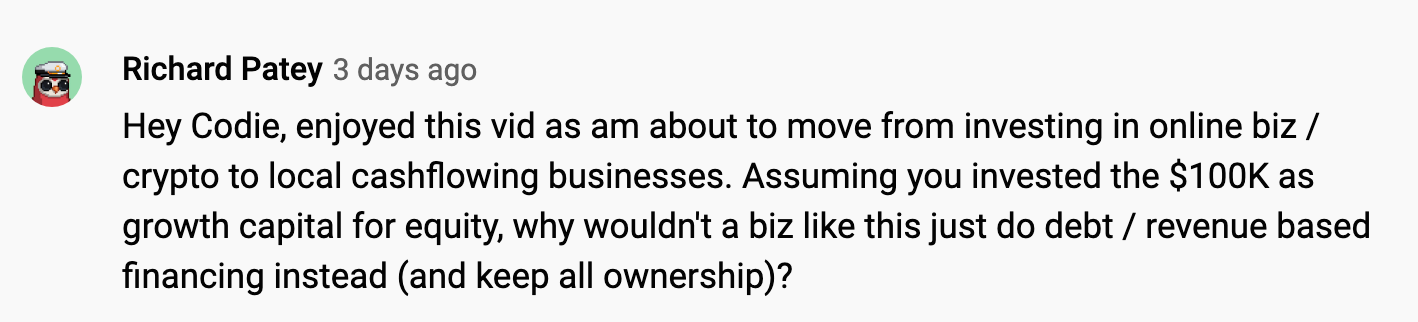

I learned what a good cashflowing business a laundromat can be, but not about how she was able to invest in exchange for what I’m assuming was equity. I left this comment on her channel:

Assuming this is a thing, I’m just going to have to try it myself. In fact I’ve started.

Last week, I spoke with the owner of a local burger truck business I frequent, asking if he was looking to scale the number of locations. Indeed he was, he gave me his card and will be meeting up to discuss a potential investment.

Can I get wrecked? Absolutely, but I imagine we’re talking about £10K bets rather than £100K, and at least I’ll get free burgers.

But my gut is telling me that if I scale this enough, make enough bets in local businesses (I’m already talking to the owner of a coffee shop I’m a regular at) then I can achieve a diversified portfolio of businesses that put cash in my pocket every month / quarter.

And if it can be done off-line, then there must be a way to achieve this with online business.

To be continued…

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

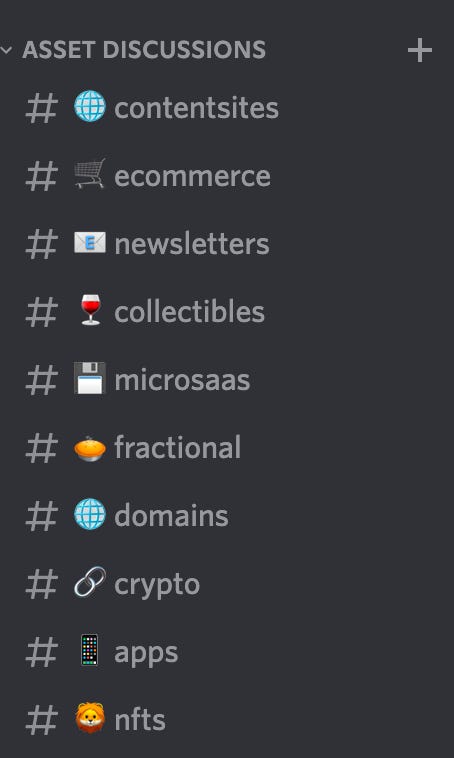

And come join the discord where we discuss:

Alts by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.

Loved the lessons from Nate Silver too. Most of the successful investors I know also play poker. Not a coincidence, I think.

Wow, Flippa! $72B is an incredible amount of liquid capital. Keep the deal flow coming:)