Discover more from Flippa

😧 I got liquidated.wtf

The rise of .wtf domains, Handshake TLD Registry open again, why I don't trust this ETH pump, and the ENS 10K club comeback

Hey there 👋,

After a heavy focus into the world of M&A over the last four weeks, this week’s Alts by Flippa newsletter is all about domains, NFTs and crypto again:

The rise of .wtf domains

Handshake TLD registry open

Crypto market manipulation

NFTs in a bear market

4 digit ENS comeback

Don’t forget to come join our Discord community where we discuss all these alt asset classes - come join over 1500 of us.

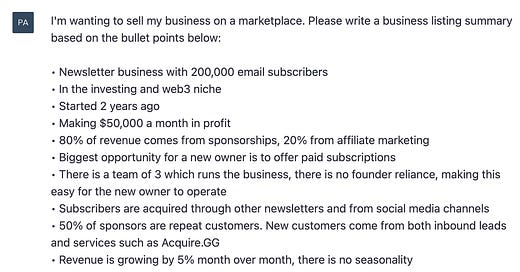

Richard Patey, Director, Investor Community at Flippa

Is .wtf the new .xyz?

Andrew Allemann from Domain Name Wire reported that the .wtf TLD was in the top 10 in Identity Digital’s Domain Trend Report for the first time.

And looking at the graph on nTLDStats it does look like there has been a big uptick starting June of this year:

Which was when I bought my first .wtf domain during the crypto carnage - liquidated.wtf!

Handshake TLD Registry open again

Namebase, the Handshake TLD registry, published their Summer 2022 Platform Updates and the big news is that their Registry is now open again for staking your TLD so you can sell SLDs.

Namecheap, who owns Namebase, is one of the registrars who will be selling names your TLD if they pick it up.

I was waiting for this since I bought the .lazy domain back in a newsletter in March. However, since then I’ve been inspired by the decentralized SLD movement by the likes of Unstoppable Domains, and Forever Domains by Mike Carson where you own the SLD forever and there are no renewal fees (i.e. not renting domain names).

On this, Namebase state:

A hot topic in the Handshake (and Namebase) community around selling subdomains has been the concept of Decentralized SLDs (Second Level Domains). This is something we are very passionate about and is the next, natural evolution for Handshake SLDs.

We have recently brought a new member to the Namebase team to help us make this a reality. In a future post we will discuss this initiative in more detail, so stay tuned.

I am indeed staying tuned.

Crypto market manipulation

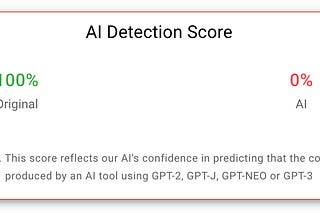

I don’t trust this current ETH pump, and nor does Travis:

We are at the same level on the weekly RSI for BTC (which dictates everything) as the last cycle bottom in 2018:

As Sofien Kaabar says in his Medium article Double Top / Double Bottom RSI Trading Strategy:

The RSI is without a doubt the most famous momentum indicator out there, and this is to be expected as it has many strengths especially in ranging markets…

This is because the more traders and portfolio managers look at the RSI, the more people will react based on its signals and this in turn can push market prices. Of course, we cannot prove this idea, but it is intuitive as one of the basis of Technical Analysis is that it is self-fulfilling.

But because crypto is such a manipulated market, the whales could be making the RSI tick up for one last final crescendo down. Plus there's the whole macro economic situation and the fact we are likely heading for a recession.

So what do I do with NFTs?

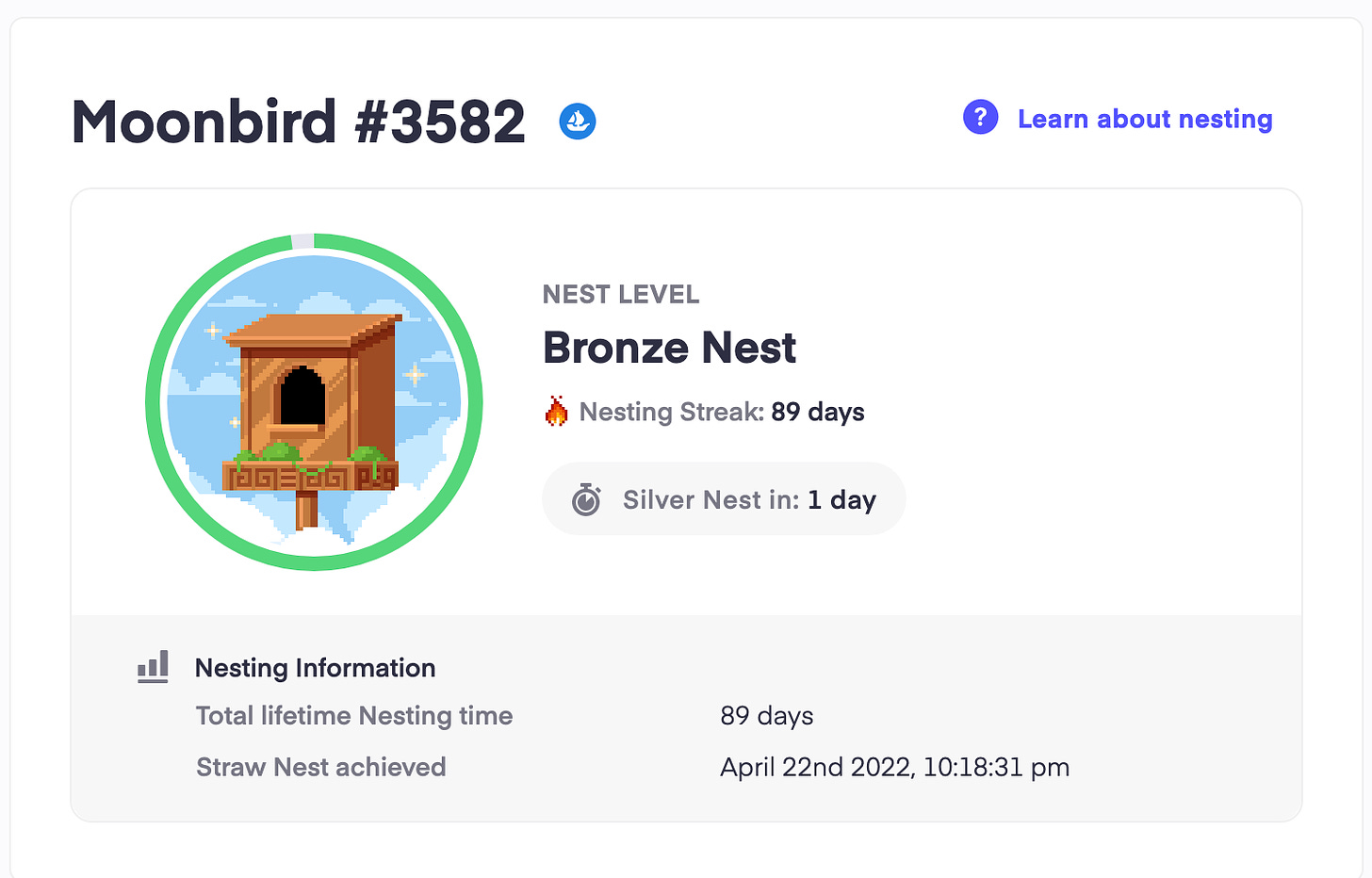

My biggest NFT is a Moonbird which I was fortunate enough to mint. I am super bullish on Kevin Rose as a builder and in terms of integrity, and I’m long on what Proof is looking to create.

But, holding (nesting) a Moonbird from $120K USD down to $15K USD when ETH crashed last month really messed with my head. It was the double whammy of seeing the price in ETH drop from 40ETH to about 17ETH, as ETH itself was dropping from $3K to under $1K.

Now the value of a Moonbird is back up to $40K USD, and seeing as I minted it for $8K I may be selling to take profit this week. I really do not want to be holding the bag if / when ETH drops big again.

For me, whether I continue to hold depends on how good the silver nest reward (for staking) is tomorrow:

Earlier this week, I sold my Moonbirds Oddity (I got for free in an airdrop) for 3.1ETH before today's reveal so that’s covered most of my mint price of the Moonbird which helps me feel more comfortable about holding. Oddities just revealed an hour ago, and the floor price has been dropping fast (as is what normally happens), currently at 1.8ETH.

I obviously know that by not having a Moonbird, or by simply un-nesting one, I won’t get future NFT drops such as a Moonbirds Raven that was leaked:

There’s also a Project Highrise NFT drop and future token drop (similar to Ape Coin) to power the whole ecosystem which I’d miss out on. I sold my Mutant Ape before the $APE drop which ended up almost being worth the price I received!

But for me, these drops only financially work in bull markets - we may get to the start of one by the end of this year, but if a Moonbird drops down to sub $10K (or worse) then I don’t think these other tokens / NFTs are going to make up for selling the Moonbird at this current local pump where I can pull out $40K.

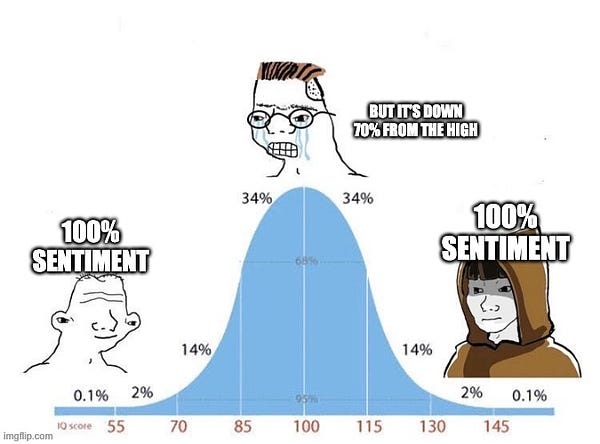

If you have a long term perspective (long term in NFT being a couple of years) then none of this should matter, holding is best. But I’ve realised that my fear of loss just beats out my fear of missing out (it’s real close), so taking profit and looking to buy back lower wins over not holding and missing out on upside.

Also, right now, possibly more than ever, I think that cash is the best alt asset you can have.

4 digit ENS comeback

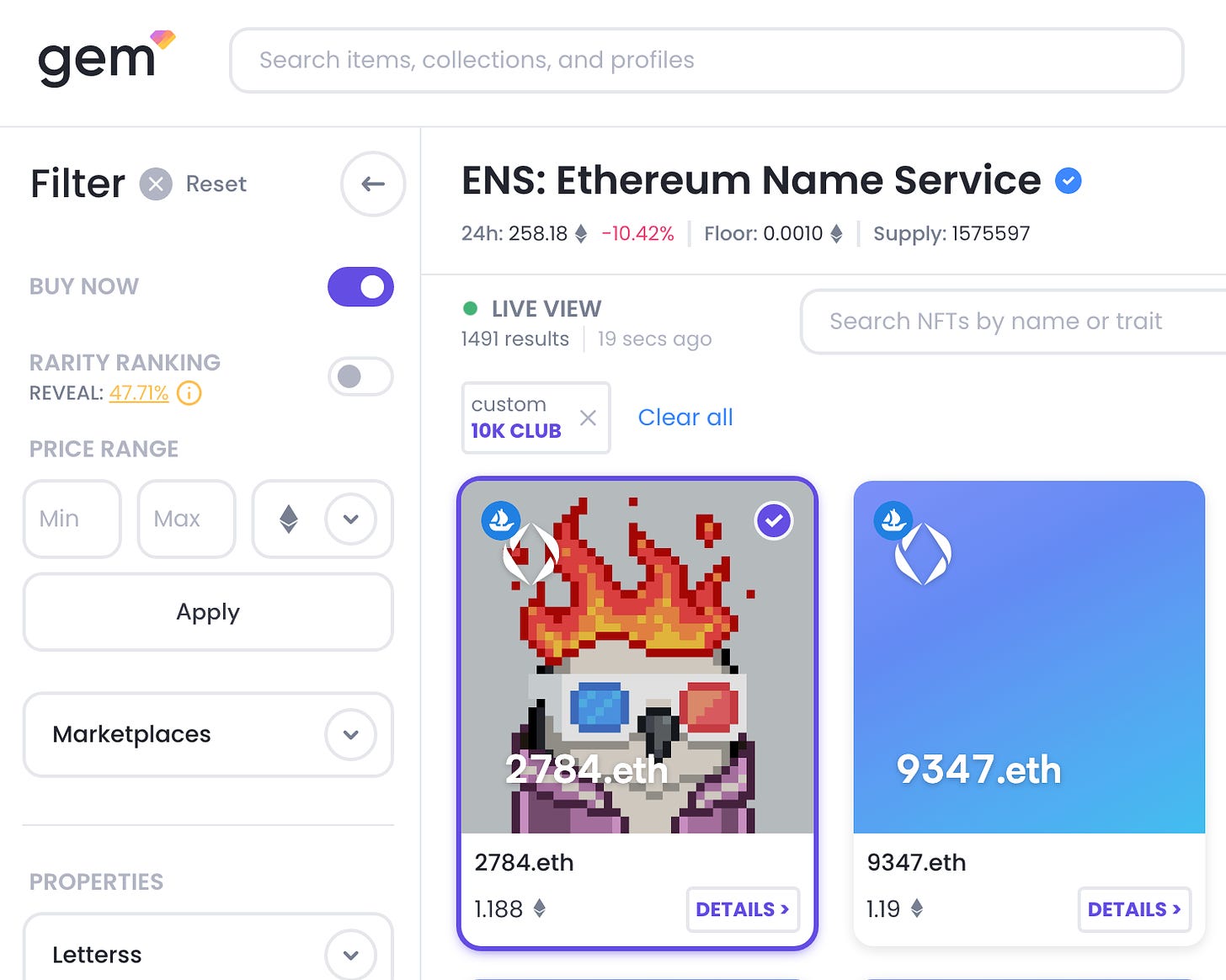

This week’s Domain Sherpa was another Down The Rabbit Hole where they were primarily discussing numeric ENS domains, which was timely as they have rebounded well since the crash.

I missed the 10K club (i.e. numbers up to 9999.eth) run up, so had to get into the 100K club instead (which I wrote about in this newsletter). I haven’t been tracking the 10K floor since, but it’s currently at 1.18ETH on gem.xyz:

Like this account, I’ll be looking to buy in if/when it drops again:

But you need to work out which ones to buy, as some numbers and variations are more valuable than others:

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

And come join over 1500 members in the Alts by Flippa Community:

Where we discuss:

Alts by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.