Discover more from Flippa

📧 Newsletter platform arbitrage?

A potential newsletter platform arbitrage play, plus good luck trying to register a web2 emoji domain in any extension (I tried and failed)

Hey there 👋,

In this week’s ALTS by Flippa newsletter I discuss:

A potential newsletter platform arbitrage play

Big change in % of online business listings sold

A five figure emoji domain sale on a .ws

Why I’m still happy to be out from crypto

Opensea launches its own NFT rarity rank

Millennials collecting USD vs fractional investing

Every heading is a discussion channel in the Alts by Flippa discord community - come join over 1800 of us.

Cheers!

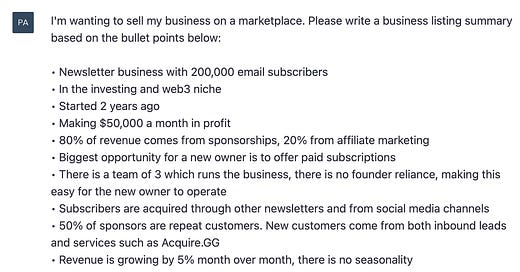

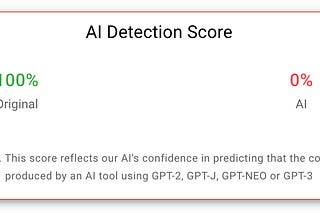

#newsletters

If you haven’t noticed, we’re back on Substack, a platform where tweets display properly and subscribers go up:

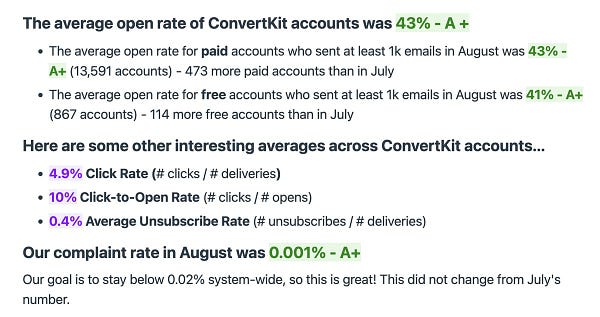

The above tweet by Andrew and the tweet (part of a thread) below by Nathan made me think there could be a potential investing in newsletters arbitrage play:

Acquire a newsletter on an inferior platform with low deliverability and switch to one with solid open rates.

If open rates are higher, then the number of clicks per send will be higher, and the more you will earn from advertisers who sponsor each send.

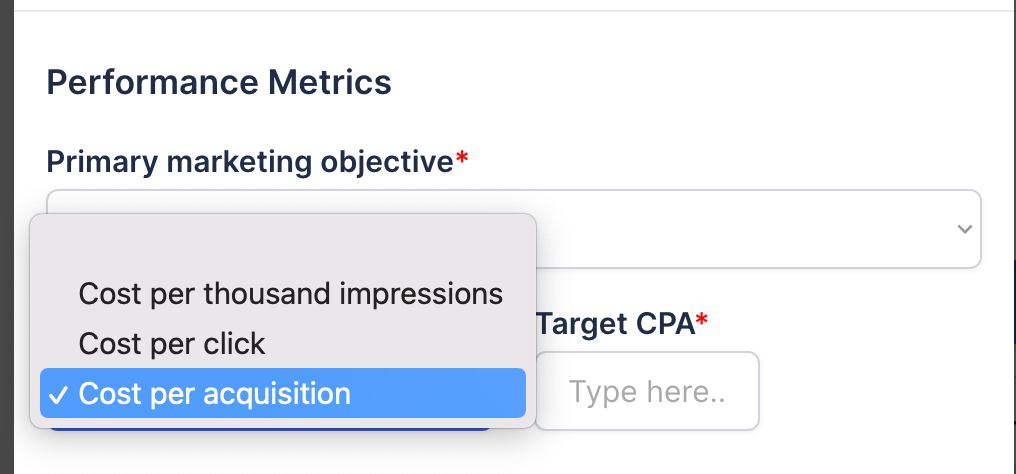

With newsletter businesses, you sell advertising on one of three models, as seen when you set up a campaign in the newsletter sponsorship platform Swapstack by Jake & Jake:

CPM - the number of impressions, which in this case means opens

CPC - the number of clicks you can generate for an advertiser

CPA - an affiliate model where you get paid for an action (which could be someone signing up to your list or purchasing a product)

I wonder if any readers have tried this.

#acquisitions

Nate at Centurica dropped some more awesome charts on the state of the online business space.

The first is tracking the total number of listings by business models over time:

Content & media (what I focus on over at Acquire.GG) have been steady, SaaS & Web Apps along with Services have been fluctuating, but the main increase since 2020 has been in eCommerce.

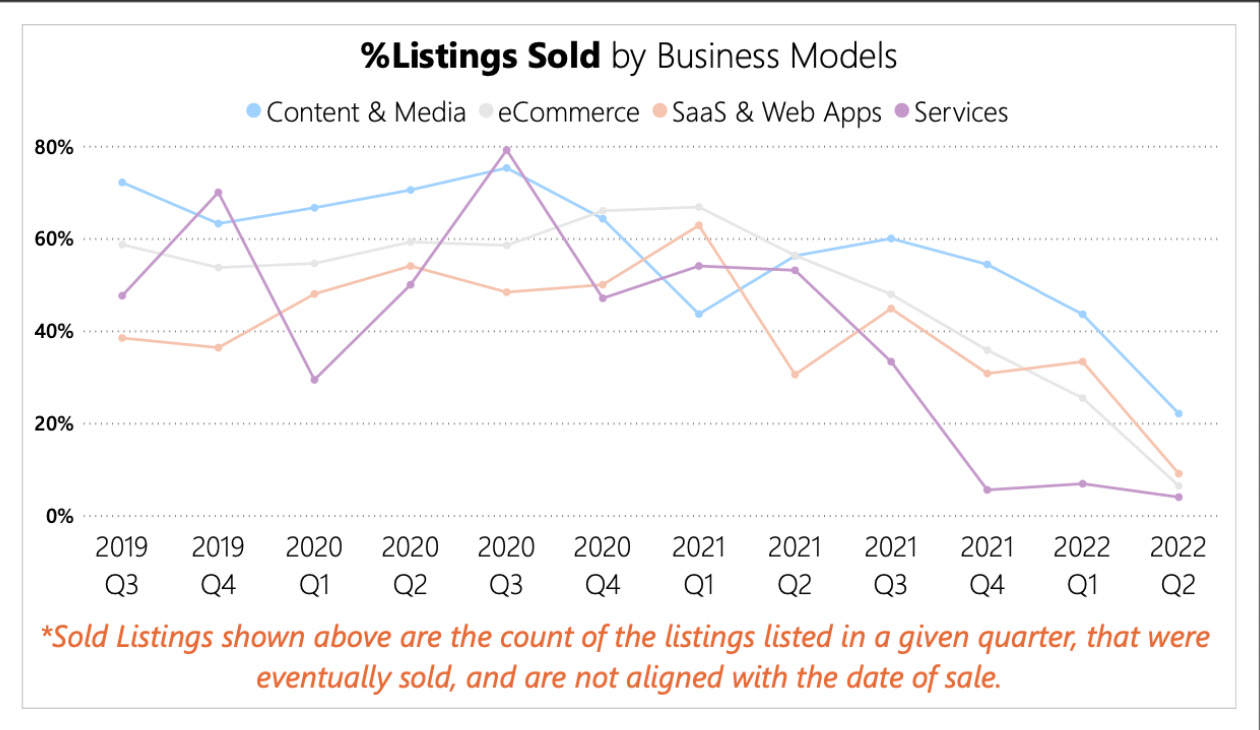

The more important metric / chart, however, is what % of these listings are selling over time:

As can be seen, there has been a big drop off in the % of listings sold across all business models since Q3 of 2021, but the steepest drop has been in Services since Q3 of 2020.

This would imply that service business multiples have been too high or buyer interest has changed.

#domains

Well this tweet by Dotsats who I’d previously known as a web3 domainer (Handshake) piqued my interest:

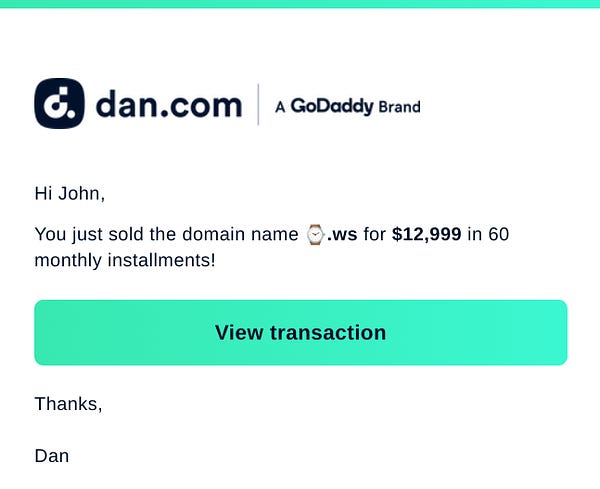

He sold a watch emoji domain on a .ws TLD for $13K.

First up, I had to google what .ws is as had never heard of it. Wikipedia states:

The . ws country code has been marketed as a domain hack, with the ws purportedly standing for "world site", website or web service, providing a "global" Internet presence to registrants, as it supports all internationalized domain names.

You can’t actually buy a ⌚.ws domain, you need to buy the Punycode which renders as an emoji. As such John had sold xn--dih.ws which is now redirecting to ocur.io.

I assume that the premise for investing in emoji domains is that more and more brands will use them in the future with their marketing, as mobile usage continues to increase and everyone has easy access to emojis on their phone keyboard.

I went shopping for emoji domais. I spent over an hour going through charactercodes.net choosing emojis I thought could be used in advertising and then heading to Namecheap to see if there were any extensions left.

I couldn’t find a single one.

Looks like I missed out on another trend, just like 3 and 4 letter ENS domains.

#crypto

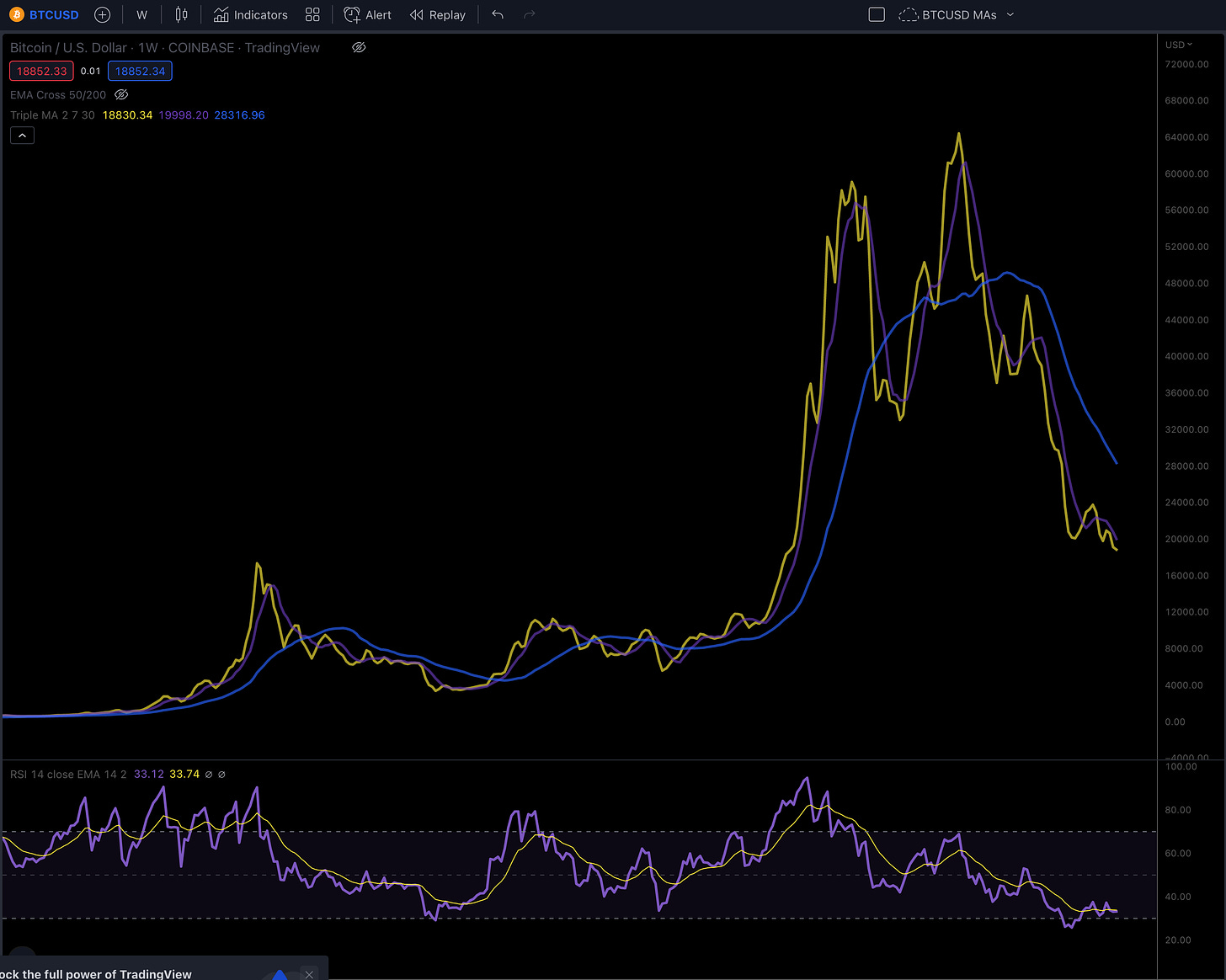

I’ve not held any crypto (other than ETH in a minimal viable portfolio of NFTs) since April of this year. It didn’t seem smart seeing that it was 4 years on from the last bear market in 2018 (the Bitcoin halving cycle).

It’s been a while since I looked at the weekly BTC chart with just the 2/7/30 moving averages (hiding the price) and the steepness of the longest MA (blue) looks terrible:

Whilst dollar cost averaging in at prices 70% down from all time highs can’t be a bad thing, I’m still waiting before I get back in and doubt it will be this year.

#nfts

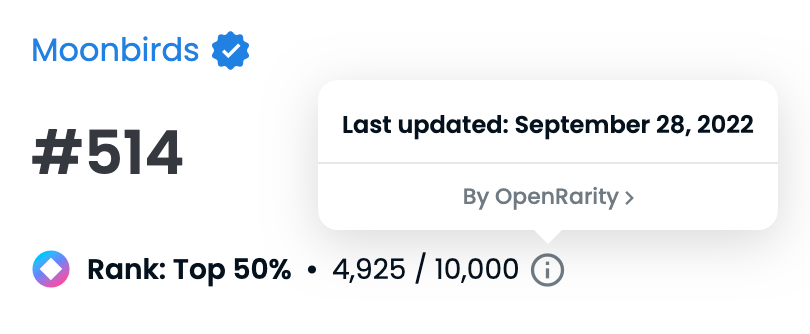

Opensea now has it’s own rarity rank showing on some collections, called OpenRarity:

You can see this with Moonbirds if you click through on one of the floor birds:

This gives investors the ability to sort by rarity and find any mis-priced NFTs dumped at the floor, something that is far more likely in a bear market when people need exit liquidity.

But this bear market isn’t stopping crypto funds from raising.

Spencer Ventures is a NFT only fund which recently raised $4.5M from institutional investors, including a family office with $10 billion in assets under management (reports Blockworks).

The founder Spencer Gordon-Sand (who I listen to most days on the NFT Morning Show twitter space hosted by Pio, Nick and Kix from The Nifty) states that there is a real appetite from the institutional family office space, who would otherwise have difficulty finding ways to deploy capital in the space.

#fractional

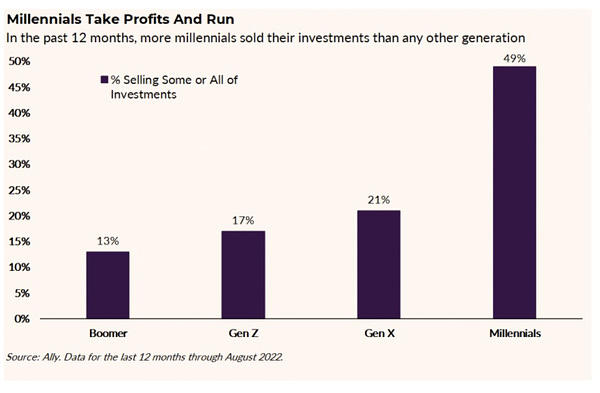

And finally, it’s been a tough time for fractional investment platforms, exacerbated by millenials (the target market) pulling a large chunk of their money out, as Wyatt from Alts.co tweets:

The need to be liquid right now is real and winter is coming.

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

ALTS by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.