Discover more from Flippa

I don’t like guessing games

It's all about risk to reward - trading, poker, crypto, & NFTs discussed this week

Nothing in this email is financial advice and I'm not a 'professional investment adviser'. I send weekly updates on what I'm doing personally - consider it 'informational' and 'for entertainment purposes only’ (as the podcasts say).

Well hello again 👋

It was great to send the email last week to launch Alts Cafe - this new free newsletter & community discussing all things alternative income & investing - especially as so many of you replied.

I’m really enjoying writing this newsletter because it’s simply about what I’m up to, which makes it easy for me to finally be consistent with my email sends. I genuinely have no idea how Juliet is able to send out two news curation emails a week for the investing.io newsletter that’s better than anything else out there. If you’re not signed up I can’t recommend it enough.

Ok so what have I been up to over the last week?

[Remember, every heading here is a channel in the Discord - come join the discussion.]

#trading

I placed my first trade on FTX. I used the RSI and TD Sequential indicators to find a setup on the Yearn Finance (YFIUSD) chart to buy (go long - I can’t go short here in the UK unfortunately).

This was a scalp play where I wanted to get as much of the move after it hit 70 on the RSI and I used a trailing stop of $1500 which means that when the price moves down (against me) by that much it gets me out. The price went from my entry at $38,800 to ~$41,700 and I got stopped out at $40,150. This got me a 3% gain which feels tiny for crypto, but 300 pips is a big win for traditional FX traders.

Going forward I’m not going to be doing much scalping, I want to catch far more of a swing in price, holding for longer. As such I’ll be waiting for the RSI to hit overbought (70+), pull back into the 40-50 range and then have the moving average trending back up before going in. I learned this technique from watching this video by Nick of Jupiter:

This way you’re not guessing which way the market is going, you’re placing probabilistic (+EV) bets with the best risk to reward.

#poker

I’ve only played a few hundred hands over the last week but am up a couple of buy-ins so it’s nice to be running well.

Like I said last week, I’ve learned a lot from Richard aka Ginge Poker, in particular about 3betting on the flop (raising an opponent’s raise) with marginal hands vs calling "to keep the bluffs in". I feel that other streamers, such as the 500nl player David Kaye (who I’m a fan of too) keeps putting himself into bad spots where he calls a flop raise, turn bet and has to guess on the river for stacks.

For example, I’m pretty sure most people would call this flop raise (click to see hand replayer) but then you have no idea if your marginal hand (top pair top kicker) is any good, i.e. does your opponent have a 7 or not? What happens if a K or a J hits the turn, does that change anything? As such I reraised (3bet) the flop and the opponent folded.

Did I expect any worse hand to call? Nope. Not every bet needs to be for value or a bluff, it’s ok to bet and take down rather than guess.

#crypto

I’ve been playing with as many wallets on as many different layer 1 protocols as possible. As I said in last week’s newsletter, I was late to the alt layer 1 rotation game as was an ETH maxi last year.

However, I’ve now bridged ETH over to Terra where I’ve staked some Luna and also UST on Anchor.

I’ve also bridged over to NEAR, added the Aurora layer 2 network in Metamask, swapped some ETH on the Trisolaris dex (no gas baby) and bought some $TRI while I was at it.

And I’ve added more alt networks in Metamask - Andromeda (METIS), Avalanche and Harmony - and made trades on all the main DEXs there too.

I’m waiting for a much deeper pullback / next bear market (if not already in the start of one) before I invest in these layer 1 protocols. However, I think there are still sick gains to be made right now in the new layer 2s and dApps.

One dApp I’m investing in is Defi Kingdoms, on the Harmony ONE network, which is a potential challenger to Axie Infinity. It gamifies DeFi with it’s own $JEWEL token, DEX and yield farming, and has its own NFTs on top. I’m still very new to it so, for now, will link up a good video that describes what it’s about and how to get into it.

#nfts

Last week I mentioned how I couldn’t see the Mutant Ape Yacht Club’s floor double within the next month which is why I’d moved into Lazy Lions. At the time the MAYC floor was at 10ETH and a couple of days ago it actually reached 16ETH (making me annoyed I sold at 8ETH!) but has dropped since.

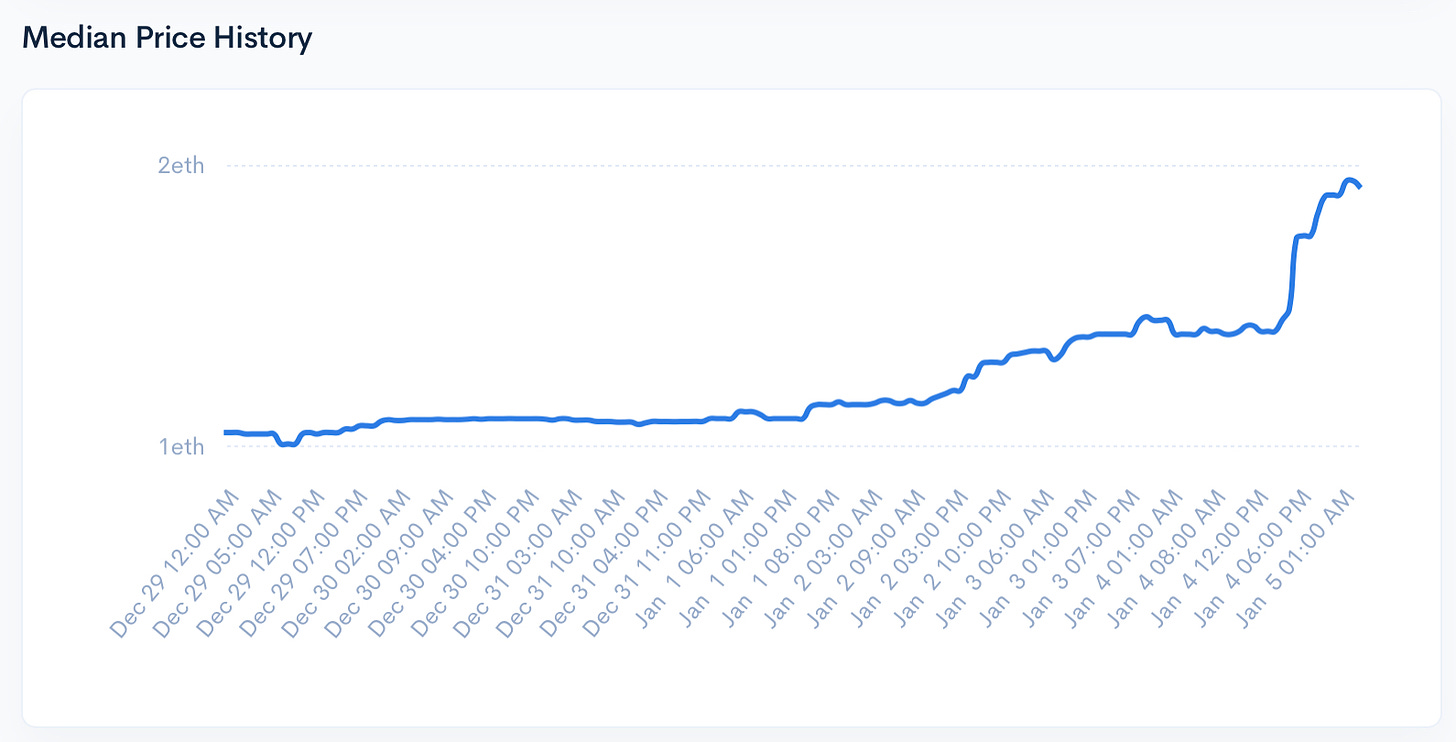

And over the last week the Lions floor has risen from 1 to 1.7ETH but the better indicator is the median price which is shooting up nicely:

When Coinbase NFT finally launches (they did say by end of year last year but missed it), the Lions are a launch partner on the platform which means I don’t need to guess if the price will rise when millions users get to buy for the first time:

That’s it from me this week, let me know what +EV bets you’re making by hitting reply or chatting in the discord.

Cheers!

Richard

ps my last email got 1500 opens and sent over 100 clicks - I’m not monetizing just yet, but if you’re interested in sponsoring this newsletter just hit reply.

Subscribe to Flippa

Flippa's alternative asset newsletter for investors. We discuss acquisition and investing opportunities from businesses to crypto.

Thanks for the mention too! I'll do my best to live up to your high praise:)

Speaking of Apes (Bored, Mutant or otherwise) have you seen the Apocalyptic Apes on Open Sea? They're yet another derivative collection of the Bored Ape Yacht Club.

Here's a link to their site: https://apocalypticapes.com/

Excited to see what happens with the Lazy Lions!