🚰 Do You Even Cashflow?

Understanding why Quality of Earnings matters on more complex biznass deals

Hey there 👋,

In this week’s Alts by Flippa newsletter I discuss:

Why Quality of Earnings matters

Centurica change of ownership

New health JV for Red Ventures

Selling sites for 72x monthly profit

Selling a business as an NFT?

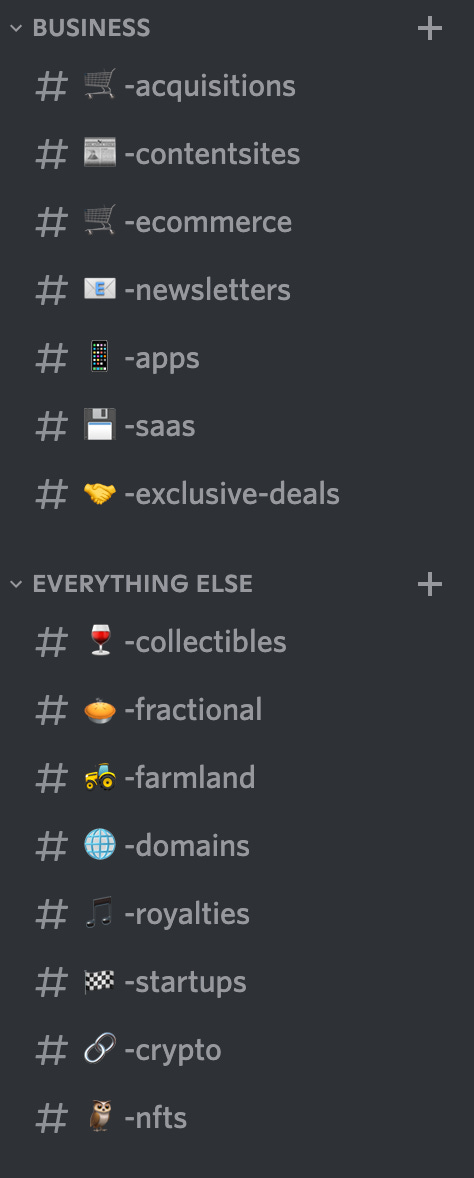

Remember, every heading in this newsletter is a channel in the Discord - come join over 1500 of us.

Richard Patey, Director, Investor Community at Flippa

#acquisitions

Following on from my newsletters about setting up a holding company and searching for businesses, I’ve continued to try to acquire my first local business here in the UK.

I met with the owner of the cafe I’m looking to buy, after he sent through his management accounts. He’s a really lovely guy and I instinctively trust him.

However, I do not know if the income statement is an accurate representation of the health of the business. With an online business like a content site (which I have built and sold) revenue, profit and cashflow are all so similar that a simple P&L will suffice in closing the deal.

But with this business I have stock, purchases, staff costs with pension contributions, and a whole range of creditors such as VAT.

Even though a cafe is a simple business to understand, I need to have a much better picture of cashflow and the impact of tax liabilities.

If this was an online business I’d pay for a comprehensive Flippa Due Diligence report or use Centurica, which is now owned by Nate Ginsburg, having recently acquired it from Chris Yates from Rhodium Weekend. Nate talks with Joe Valley from Quietlight Brokerage (who is one of Flippa’s affiliate business brokers) about the deal in the podcast below:

However, in my case I’m getting a local accountant to do a quality of earnings report. I’ve not personally run into this yet in the online business world, but it’s something that will become more common within Flippa as it continues to move into the lower middle market.

There are online providers who will do QoE, such as DueDilio by Roman Beylin:

But for this deal, I wanted someone local to generate this report and potentially even meet with the owner.

QoE reports on how a company makes its revenues, by breaking down cash sources. A company can report strong net income but poor quality earnings. The report will normalise earnings (especially important over the last couple years due to covid) and will also look at things like payroll issues and recommend any tax benefits to take advantage of.

I will be buying this business as an investor/owner due to the cashflow it can generate. As such, I need to know the ratio of net cash to net income - and I’m not financially sophisticated enough to trust that I can do this well enough by myself.

I learned a lot about QoE from Adam Coffey from CEO Advisory Guru who was recently on the M&A Science podcast by Kison Patel, CEO of DealRoom. The conversation was about sell-side M&A but I was listening as an investor, understanding the importance of good financials to speed up the acquisition process:

#contentsites

Moody’s and Axios reported that Red Ventures (that owns large websites such as CNET) and UnitedHealth Group have created a joint venture called RVO Health.

The new company pulls together health media properties such as Healthgrades, (doctor reviews) and Healthline (medical info) with Optum Perks (prescription drug saving cards) and Optum Store (health and wellness home delivery).

This network of sites will be able to cross-promote their own products (rather than be an affiliate of others) to significantly drive revenue, whilst also being able to increase the value to advertisers.

Moody’s states:

RVO Health combines UHG's scale of 120 million customers and 50 million members with RV Health's 95+ million monthly unique visitors to create a compelling consumer digital health platform of complementary assets. The JV will accelerate RV Health's access to new products, services and solutions, as well as provide access to a sizeable first-party data audience, while UHG will enhance its digital transformation and momentum from Red Venture's technology platform and digital marketing expertise.

Sounds like a formidable force in the SERPs to me.

And at the smaller end of the content site spectrum, Flippa Broker Joe Burrill strikes again:

Joe was able to sell this content site on Flippa that was making $763/m in profit for over $55K! That’s a monthly profit multiple of 72x or 6 years profit!

I’m very jealous as back in 2017 I sold a website through a well known brokerage for a similar amount, on an asset that was making $2K/m (this was 5 years ago when multiples were lower but still!).

How this is possible is due to one of Flippa’s unique features, the auction, combined with no reserve to create a bidding war.

I asked Joe whether you can achieve the same with an asset doing say $2K/m in profit and this was his response:

Honestly it is less likely the higher you go, with the big caveat being something that is positioned perfectly for a 8+ figure buy out (by Google for example). These are exceptionally rare and are not called unicorns for nothing. The reason it is less likely is due to the thinner buyer pool at the higher price points. It is also rare that you’d find buyers who overvalue businesses. If you’re going to spend this sort of money, you typically do enough research to find out what the asset you are buying is worth, or how to value them. In this one case, there was only one monetisation method, newor media. I believe there is a lot of room for growth with this business, PLUS it was extremely well built.

It really does pay to set up your site structure in a way where a new buyer can easily add new content silos.

#nfts

And finally I did a Twitter space yesterday with 0xMenace on whether you can sell a business as an NFT. We didn’t resolve much but had a great conversation which moved to property investing with NFTs to Moonbirds (where the floor has bounced back from 17 ETH to now 27 ETH) as a lot of people on the call owned them. You can replay the convo here.

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

And come join over 1500 members in the Alts by Flippa Community:

Where we discuss:

Alts by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.