Discover more from Flippa

🧑💻 A Micro-SaaS DAO?

Looking at cashflow investing options, utilizing operating companies and a future DAO acquisition model

Hey there, this week’s newsletter is in a different, more evergreen format.

It follows on from the Back to (online) business published two weeks ago.

But before we get started, here’s the CTA to come join over 1100 people in our Discord community:

Richard Patey, Director, Investor Community at Flippa

Cashflow is king

I was recently reminded by a top Flippa buyer of my post on the investing.io substack back in December ‘The best alternative asset’, where I discussed that I had come fully out of crypto and stocks and was sitting in cash. I was arguing at the time that the best alternative asset was indeed cash.

I got it half right.

I’ve now realised - and I don’t know why it’s taken me this long - that the best alternative asset is a cash flowing online business.

This is strange as building cash flowing businesses is all I’ve done for the last decade. But I would build up assets to then sell. Every single time.

I thought the exit was the goal.

But after each exit, my cashflow would drop significantly and I’d be back at square one, with more capital to my name but little hitting my bank account every month.

I was always confident I could quickly build up new revenue streams, or even just play online poker (tax free in UK).

I was also confident that I could increase the size of my capital through investing in crypto and most recently NFTs.

But I’ve now realised that none of this matters if that capital doesn’t end up back in the same asset class I understand well and have habitually sold.

I know no better single overall asset class to invest in for income than online business - content sites, ecommerce stores, SaaS businesses, app portfolios. If you’re buying at a 4x annual profit multiple then you’re receiving 25% annual returns if profit stays at the same level.

The messy part, however, is operations.

On the latest Acquisitions Anonymous podcast (released today), Michael Girdley was interviewing Codie Sanchez who was dropping bombs about operations:

The through line is it has to cashflow to me on an annualized basis and paid out quarterly with some consistency and there has to be a good operator in place…

…Hiring a good operator is my biggest pinch point: it’s good operators that want to run this even if I incentivize them and pay them a lot. The problem is not capital, we can all raise a lot of money if we wanted to, the problem is having these operators.

And so I like the idea of operators that allow me, or businesses that allow me to minority invest in them with enough juice and upside, which is what these investable picks and shovel businesses have, the operators can stay on, I can give them enough money that is meaningful for me but it won’t destroy their long-term incentive because they can grow more than like if I take 51% of a laundromat why would anyone continue to operate that unless I go with a guy and buy 10 or 20 of them.

Indeed, it’s easy to find physical real estate companies that will manage your properties, and there are real estate investing platforms like CrowdStreet that will manage every aspect of your investment.

But for online business, this infrastructure has not been built out yet.

As Sam Bass from Chief Operators states:

The hardest part of investing in private online businesses is finding the right operator.

Here are the current options for investing in online business as I see it:

Buy 100% of the asset and put an operator in place to run the business

There are companies that offer management services for websites, such as Buzzlogic and Domain Magnate.

Invest in a group buy / fund

You can pool your capital with other investors on a deal by deal basis (a group buy), or into a fund structure that buys and manages a number of websites. A fund can offer diversification and passive returns but you’re still reliant on a single operating entity (individual or company) keeping your website up to date and navigating Google updates.

Invest in and join a DAO

I recently came across Eyal Toledano who writes the Micro Angel substack newsletter. He published his investment thesis last year on how he’s turning $500K of his own money in into $1.4m over the next 2 years through micro-acquisitions within his Fund 1.

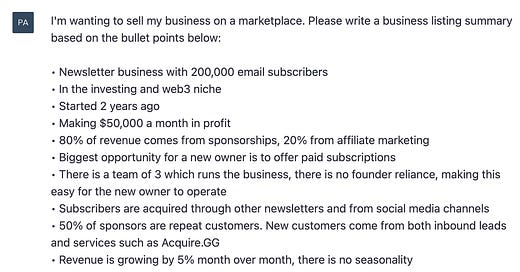

His Productizing MicroAngel Returns: Part One post sets out his micro-saas acquisition model (vs bootstrapping himself or investing as a VC) which he wanted to expand to other investors (with Fund 2) who do not want to get involved in operations:

As an investor, I want to maintain the same rate of return without necessarily having to operate products.

Similarly, as an operator, I’m limited by the number of products I can operate and can realistically only scale through more people. It’s rare to find a product that runs itself post-acquisition because most people acquire products with a clear idea of what to do with the product after it is purchased.

So in reality, I’d like to find a way to maintain the same returns and the resulting quality of life that these returns enable while reducing the need (or requirement) for me to operate anything.

He thought about trying to achieve this through minority investments in existing SaaS businesses, effectively trying to acquire chunks of MRR. And because Eyal has been a crypto investor for several years, his thinking went to building a blockchain platform to achieve this:

An NFT is interesting as a mechanism because it would allow the seller to package up MRR within a single NFT, and to limit the total number of NFTs in such a way that their value will continually rise as a consequence of being a limited resource representing a larger and large total amount, very similar to a non-inflationary currency which would see its value grow as money supply grows.

However in his Productizing MicroAngel Returns: Part Two post he realises that the way to achieve this is not through buying chunks of MRR, rather to acquire whole businesses:

The gap is greater still when introduced to the idea of simply buying MRR rather than buying products outright and operating them.

The gap sure exists but it would still be a lot of work to find the right products to buy MRR from, not to mention other mechanisms used for sending offers, receiving payments, and so on.

It’s a lot to manage manually so forget doing it at scale.

He’s now looking to create a MicroAngel DAO (Decentralized Autonomous Organization):

Those who know my background will know that for most of last year I was effectively full-time working within the media DAOs Bankless and Forefront - I wrote about it in my personal newsletter.

The DAO Eyal is looking to set up would allow a group of investors to co-invest in micro-acquisition projects together. DAO members would then share the cashflow generated by the MicroSaaS portfolio held by the DAO. And DAO access tokens (NFTs) which vote on acquisitions and receive the cashflow could be traded on secondary markets such as Opensea.

He published a thread on Twitter yesterday with his latest thinking:

And here’s another great recent thread on cashflowing business ideas:

I’ve collated some of the best online business answers below:

And if you want more ideas, Nick Huber has a post on a huge number of off-line boring businesses that he loves, such as lawn mowing, pest control and firewood delivery.

Ok that’s it for this week. If you’re reading this on the web and you’re not yet subscribed just hit the button below.

And come join the discord where we discuss:

Alts by Flippa is owned by Flippa. Nothing in this email is financial advice and we are not professional investment advisers. We send weekly updates on what we're doing personally - consider it informational and for entertainment purposes only.

You've outdone yourself, Mr. Patey. There are so many fascinating links in here that I don't know where to click first. Thanks for the heads up on the MicroAngel DAO. I love this stuff!