🥧 Actual Fractional Ownership

Actual fractional ownership of alternative assets, trading traditional and ENS domains, and how a professional poker player made me money

Hi there,

You’re going to have to wait one more week for an announcement that will dramatically boost the Alts Cafe alternative investment community.

But in this week’s newsletter I discuss:

Actual fractional ownership of alternative assets

Trading traditional and ENS domains

Why I’m more an NFT flipper than an investor

How a professional poker player made me money

Remember, every heading is a channel in the Discord - come join over 170 of us.

Cheers!

Richard Patey

#fractional

Koia is building a community-driven platform to buy, collect and trade fractional ownership in alternative assets, from collectibles to watches to NFTs.

For NFTs, Koia will mint fractions of the asset using the same ERC-721 non-fungible tokens rather than ERC-20 fungible tokens. This makes it actual ownership of the underlying asset vs just representing ownership, as in the case with my experience of buying shares of Cheetah Gang on Fractional.

And for real world assets, Koia is again using NFTs rather than creating a company and shares for each drop, such as what Rally does, which has been unattractive to me and kept me out of fractional investing until this point.

Koia takes care of authentication, storage and insurance. And their longer-term vision incorporates the fusion of real-world assets with usable digital replicas in the metaverse - they call this asset-backed NFTs.

I had a call with the co-founder of Koi, Richard Draper, and what they have in store is super exciting. I’m whitelisted to buy whatever their first drop is, and they have their own Kollector token planned which will grant advanced access to premium drops, exclusive in-person events and merch.

They have chosen Polygon for their token mainly due to its availability on OpenSea so they can produce tokens that can be traded outside of their ecosystem giving full liquidity. This also creates some interesting alpha opportunities where if the price on a secondary market is below the underlying asset price, you have the ability to buy up 60% of all fractions and force a sale.

And having NFT ownership of an asset means there is the option to be able to stake or lend for yield, and even borrow against your ownership to reinvest in other alt assets.

#domains

Cloudname, a platform for domain name traders (mentioned a couple of weeks ago), has announced it’s launching its $CNAME token on Polkabridge on February 20th.

Polkabridge is, of course, based on the Polkadot blockchain, but uses Moonbeam's parachain solution to enable Ethereum compatible smart contracts to run.

It’s been on my to-do list to go deep into the Polkadot ecosystem for some time, and now looks as good a time as any with the $DOT token down over 65% from its ATH 3 months ago:

The first domain-related token to launch was $ENS by Ethereum Name Service last year. ENS are .eth domains which can be used as your web3 username, such as patey.eth I hand registered.

But ENS domains are also NFTs, on the (Ethereum blockchain hence the name) which are actively traded.

There are over 80K ENS domains on the secondary market on Opensea you can buy now, and it’s super interesting to see the sale prices of these NFTs happen in real-time and the names of the addresses buying them:

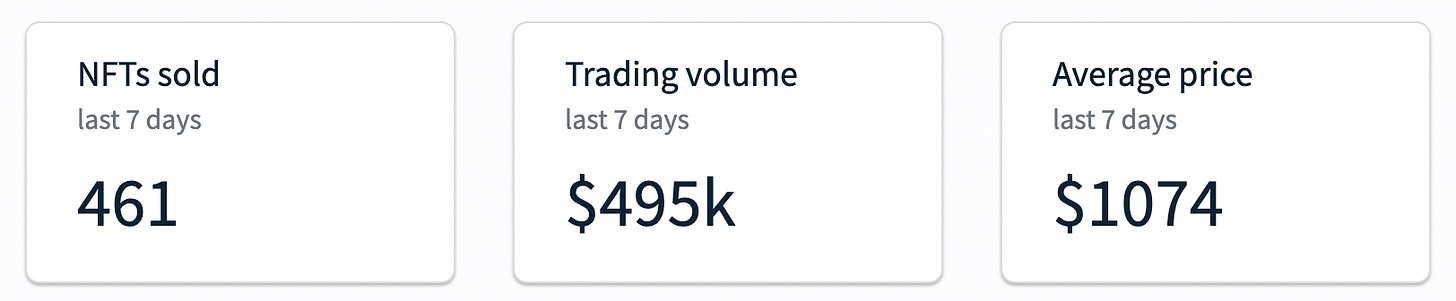

According to nft-stats.com the average price of a .eth domain sale is over $1K the last 7 days:

And it’s wild to see sales like this:

With ENS taking first steps to adopting layer 2 solutions to make gas way less expensive when trading, I wonder how many traditional domain name marketplaces will start to list them. Sedo supposedly was the first to add support for .eth but I couldn’t find any listed on the marketplace.

#nfts

I found this thread on twitter about how someone turned < 1 ETH into > 150 ETH super interesting as it made me realize that I’m more of an NFT flipper than investor, and that I could achieve similar:

My first NFT purchase was a Lazy Lion back in August last year at 0.66 ETH.

As the price remained flat for a long time, I started doubting the project and sold to look elsewhere. I did pretty well flipping Crypto Dads and ended up in a position where I was able to buy a Mutant Ape.

But first, I spent weeks researching all the different traits on Opensea like Cirrus suggests:

I was then confident enough to buy a floor mid-tier red hat mutant for 4.2 ETH as knew I had found a good deal - immediately by taking this mutant off the market, the next floor for the red hat trait became something like 4.6 ETH so on paper I had made money (if someone were to buy at that buy now price).

And this is the thing with non-fungible tokens - as each NFT in a 10K project is different, so are people’s preferences. Just because the floor of a trait is X ETH does not mean you will be able to sell it for that, at least quickly, as people’s offers are typically 10-20% below the floor price.

I sold my Mutant ape for 8.4 ETH as the offer was in fact above the floor price at the time and a good price for the trait. However, I was kind of regretting doing that as the floor is now 20 ETH and the buy now price for red hats is 25 ETH.

But I was wrong to regret as now realize I’m a flipper - I made 2x and had liquidity to buy multiple Lazy Lions.

Going forward I’m going to continue to focus on better understanding the sales activity and trait floor prices of both Lazy Lions and MAYC. I’ve said previously I’ll be selling one of my Lions after the Coinbase NFT marketplace launches as I’m expecting a pump in the price. As such, I’ll be looking to get back into MAYC which will hopefully have dropped by then, and continue to flip.

#poker

So my first investment into a poker player using the Pocket Fives staking platform went well:

If only I’d put more in as Brock Wilson bought into the $50K buy-in tournament and came second taking down $416K.

This is obviously a huge amount of money, but looking at my crypto investments in terms of 10x bets and NFTs in terms of 2x flips, I was wondering what the long-term ROI of top poker tournament poker players is.

$50K > $416K is only 8x and you’re only going to hit that payout something like 1 in 50 tournaments.

Indeed, poker websites state that professionals aim for 40% ROI in live play with the very best making 80%.

So I think it’s reasonable to expect to achieve 20% ROI if you’re staking top players over the long run, if you are able to make enough bets.

Not a bad alt asset for passive income, where you don’t have to be the one playing tournaments for 18 hours at a stretch.

Ok that’s it for this week.

If you’re reading this on the web and you’re not yet subscribed just hit the button below.

And come join the discord where we discuss:

And feel free to follow me on Twitter.

Cheers!

Richard

Nothing in this email is financial advice and I'm not a 'professional investment adviser'. I send weekly updates on what I'm doing personally - consider it 'informational' and 'for entertainment purposes only’ (as the podcasts say).

Great newsletter today, Richard. Thanks for the heads up on Koia and poker staking. I'll be checking those out.